How The Employee Retention Tax Credit may end on Sept30 can Save You Time, Stress, and Money.

A Guide to Claiming the Employee Retention Tax Credit – NADA

Fascination About ERTC FAQs - Payroll Vault

It has actually been considerably broadened to supply more financial relief to a bigger group of employers. Employers can make the most of the ERTC against federal employment taxes by means of qualified incomes paid to their workers from March 13, 2020 to December 31, 2021. Related Source Here can retroactively declare the credit versus previous quarters.

ertc - YouTube

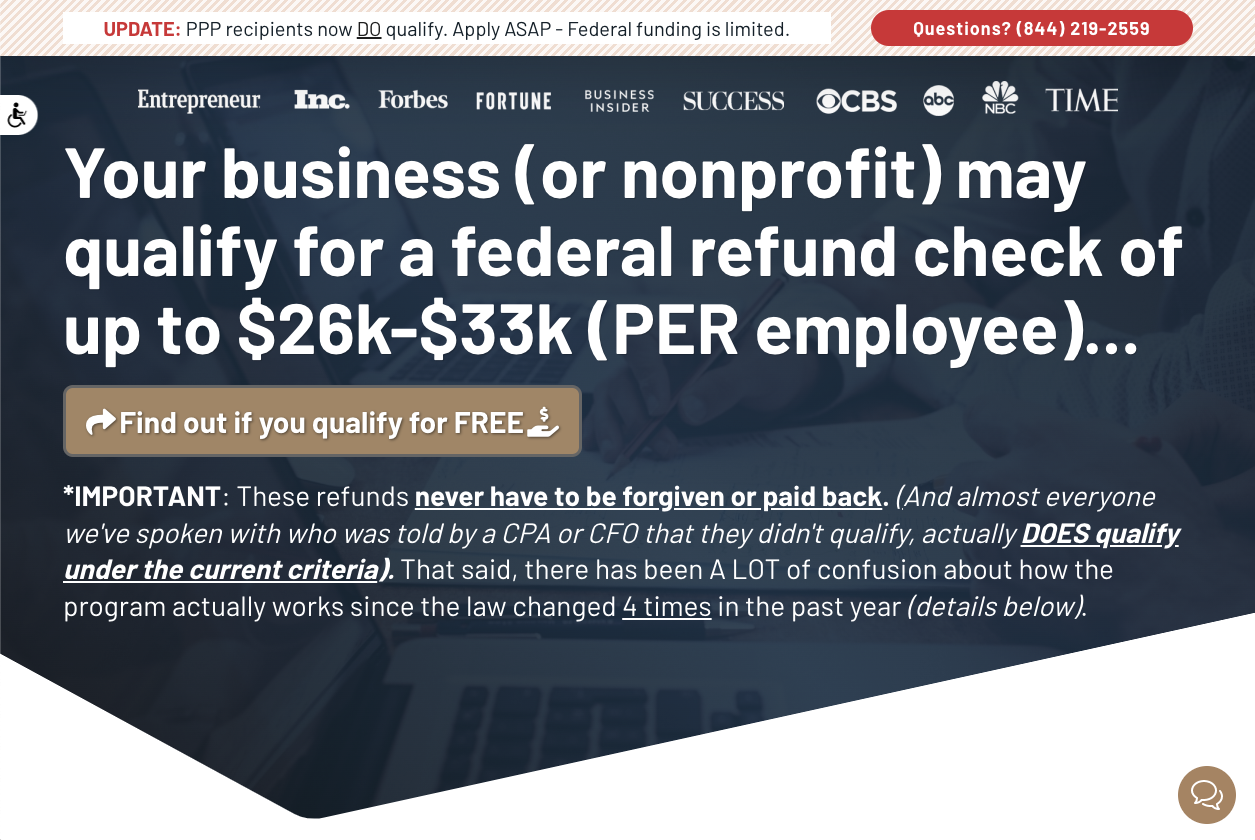

ERTC Tax Credit Experts – Are you getting all the money from the CARES Act possible for your business?

Updated November 2021: The Infrastructure Investment and Jobs Act reduced the active period for the ERTC, removing Q4 2021. This modification brings the overall value of the credit to an optimum of $26,000 per staff member on payroll throughout tax years 2020 and 2021. Nevertheless, Healing Startup Services are an exception to the change, and may still be qualified for Q4 2021 under particular situations.

We highly suggest you speak with a professional accounting professional to optimize the worth of your tax credit. Who's eligible? Private services or tax-exempt companies that carry out a trade or business that experience one or both of the following requirements: Business was forced to partially or totally suspend or limit operations by a federal, state or local governmental order Business experienced a 50% decrease in gross invoices throughout any quarter of 2020 versus the exact same quarter in 2019, and/or a 20% decline in gross receipts 2021 against the exact same quarter in 2019.